Edelweiss: India’s Financial Giant With a Regulatory Rap Sheet

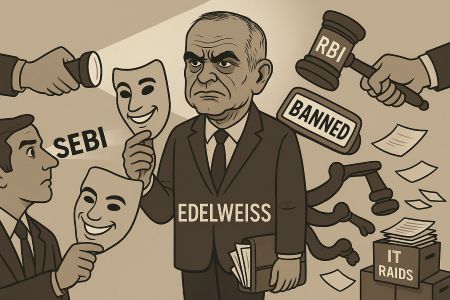

EDELWEISS GROUP, once hailed as a symbol of India’s financial ambition, is today battling on multiple fronts. In just two years, the group has faced a crippling RBI ban, a SEBI penalty that barred its executives, income tax raids, and even courtroom perjury proceedings.

With its chairman Rashesh Shah himself named in a police FIR after the suicide of art director Nitin Desai, the question is no longer whether Edelweiss bent the rules — but how long it can survive regulators, courts and public scrutiny closing in from all sides.

In August 2025, when the Securities and Exchange Board of India (SEBI) ordered Edelweiss’s alternative investment funds to pay ₹61.42 lakh and barred senior officials for a year, it looked like just another penalty in the long list of corporate settlements.

In August 2025, when the Securities and Exchange Board of India (SEBI) ordered Edelweiss’s alternative investment funds to pay ₹61.42 lakh and barred senior officials for a year, it looked like just another penalty in the long list of corporate settlements.

But the story of Edelweiss is no ordinary compliance lapse. It is the story of a financial empire repeatedly called out by every pillar of India’s regulatory and judicial system — SEBI, RBI, the Income Tax Department, and even High Courts — yet carrying on business as if rules are optional and accountability negotiable.

SEBI’s Rebuke: Misrepresentation and Leadership in the Dock

SEBI’s August 2025 settlement was unambiguous. Edelweiss ESTAR and Edelweiss Alternative Asset Advisors (EAAAL) had failed to disclose conflicts of interest, strayed from their own placement documents, and misrepresented facts to trustees and investors. For this, they were fined and forced to sideline key officials for a year. Crucially, SEBI warned that this was no immunity deal: fresh disclosures could reopen proceedings.

This was not Edelweiss’s first brush with SEBI. In October 2024, the regulator fined Edelweiss Asset Management Ltd., its CEO Radhika Gupta, and fund manager Trideep Bhattacharya a total of ₹16 lakh for violating mutual fund rules.

This was not Edelweiss’s first brush with SEBI. In October 2024, the regulator fined Edelweiss Asset Management Ltd., its CEO Radhika Gupta, and fund manager Trideep Bhattacharya a total of ₹16 lakh for violating mutual fund rules.

Their flagship “Focused Equity Fund” had exceeded its 30-stock cap on 88 separate days — a blatant breach of its own mandate. By naming Gupta, SEBI signalled that the lapses weren’t technical slips buried in paperwork. The leadership itself was responsible.

Taken together, the regulator’s orders painted a picture of systemic disregard for fiduciary duty.

RBI’s Quarantine: When the Central Bank Drew the Line

If SEBI’s actions exposed cracks, the Reserve Bank of India blew a hole in Edelweiss’s fortress. In May 2024, the RBI banned Edelweiss ARC and ECL Finance Ltd. from acquiring stressed assets or entering structured deals. The charge: evergreening loans — disguising bad debts by cycling them through internal entities and connected AIFs.

The RBI found security receipts mis-valued, debts misreported, loan-to-value norms ignored, and KYC rules bypassed. For an ARC whose survival depends on acquiring distressed loans, the ban amounted to a regulatory quarantine. Though lifted in December 2024 after “remedial steps,” the stigma remains: the RBI declared that Edelweiss’s governance was rotten.

The RBI found security receipts mis-valued, debts misreported, loan-to-value norms ignored, and KYC rules bypassed. For an ARC whose survival depends on acquiring distressed loans, the ban amounted to a regulatory quarantine. Though lifted in December 2024 after “remedial steps,” the stigma remains: the RBI declared that Edelweiss’s governance was rotten.

Adding insult, in June 2024 the RBI also refused to extend the term of R.K. Bansal, Edelweiss ARC’s managing director and CEO, despite his stature as head of the ARCs’ industry association. It is rare for the central bank to deny extension to a sitting industry leader. The message was unmistakable: the failures were systemic, and they began at the top.

The SARFAESI Shield Turned into a Sword

For those outside the banking world, Edelweiss’s most visible face has been its Asset Reconstruction Company (ARC). Under the SARFAESI Act, ARCs are given special powers to recover debts without long litigation. But Edelweiss ARC has been accused of turning this law into a weapon.

Borrowers allege that Edelweiss seized properties without notices, inventories, or panchnamas. Affidavits were filed before District Magistrates under Section 14 that later turned out to be false.

Borrowers allege that Edelweiss seized properties without notices, inventories, or panchnamas. Affidavits were filed before District Magistrates under Section 14 that later turned out to be false.

Assignment deeds — the very proof of debt acquisition — were allegedly forged or manipulated. Police were called in to evict lawful occupants with little more than an Edelweiss letterhead.

The most visible flashpoint came in Patiala in July 2024, when Edelweiss ARC forcibly seized the premises of PT Media Pvt Ltd without following due process.

Even unsecured assets — including cash, personal and professional valuables, digital archives and invaluable manuscripts with a notional value of nearly ₹50 crore — were taken without any legally compliant inventory or videography, in clear violation of mandated safeguards.

Kanwar Manjit Singh, journalist and Director of PT Media, has accused Edelweiss of fraud, forgery and perjury, and in a pending defamation case has sought ₹5 crore in damages for the reputational and business loss caused by what he terms an unlawful action.

Punjab & Haryana High Court: Perjury Cannot Be Brushed Aside

When Edelweiss ARC tried to block the perjury complaint, the Punjab & Haryana High Court refused.

In July 2025, the court allowed the District Magistrate of Patiala to proceed with the enquiry.

This meant that Edelweiss’s top brass — including those who signed contested affidavits — could face perjury proceedings. For a group used to settling with regulators by writing cheques, this was something new: personal legal exposure in a court of law.

A Death Blamed on Edelweiss: The Nitin Desai FIR

Even before these regulatory storms, Edelweiss’s name was tied to a tragedy that shook India’s cultural world. In August 2023, legendary Bollywood art director Nitin Desai died by suicide at his Karjat studio. He left behind voice recordings and notes blaming Edelweiss for his ruin. His company, ND’s Art World, had borrowed from ECL Finance.

In his final messages, Desai accused Edelweiss of relentless harassment. His widow’s complaint led to a police FIR under Section 306 IPC (abetment of suicide), naming none other than Edelweiss chairman Rashesh Shah, ARC head R.K. Bansal, and three senior executives.

When they rushed to the Bombay High Court to quash the FIR, the bench refused to grant interim relief or protection, leaving the investigation alive.

For the first time, Edelweiss’s top leadership faced not regulatory penalties, but criminal allegations of driving a man to his death.

Income Tax Raids and Trading Probes

The troubles didn’t stop there.

The Income Tax Department raided Edelweiss offices in Mumbai, seizing documents linked to suspected irregularities.

In July 2025, its affiliate Nuvama Wealth (formerly Edelweiss Broking) was searched in connection with the Jane Street trading probe, which examined expiry-day manipulation and suspicious profits.

From market regulators and the RBI to taxmen and police, the list of agencies probing Edelweiss keeps widening.

Rashesh Shah: Policymaker Turned Defendant

At the heart of this storm sits Rashesh Shah, co-founder and chairman of Edelweiss. For years, Shah was feted as the face of new Indian finance — a policy adviser, former FICCI president, and SEBI committee member. But his tenure has also coincided with Edelweiss’s darkest period.

He was summoned by the Enforcement Directorate in 2020. He is a named accused in the Nitin Desai suicide FIR. He is a respondent in the Patiala perjury case.

He was summoned by the Enforcement Directorate in 2020. He is a named accused in the Nitin Desai suicide FIR. He is a respondent in the Patiala perjury case.

His ARC has been banned by the RBI and fined by SEBI. The man once shaping rules for India’s financial markets is now defending himself against charges of forgery, harassment, and abetment.

The Pattern: Too Big to Punish?

Across SEBI, RBI, Income Tax, High Courts, and police FIRs, the pattern is unmistakable. Edelweiss bends rules, regulators intervene, penalties are paid, and business continues. But the accumulation of sanctions — from disclosure failures and evergreening loans to forged affidavits and criminal FIRs — is no longer coincidence. It is a system of defiance.

The unanswered question is not whether Edelweiss has broken the law. The record says it has.

The real question is whether India’s regulators and courts will finally act in concert to show that no financial conglomerate is too big to punish.

This story is still unfolding. From regulatory bans and market penalties to courtroom perjury enquiries and even a criminal FIR, the Edelweiss saga grows darker with every disclosure.

This story is still unfolding. From regulatory bans and market penalties to courtroom perjury enquiries and even a criminal FIR, the Edelweiss saga grows darker with every disclosure.

At its centre stands Rashesh Shah, the group’s chairman, once celebrated as a policymaker and industry voice, now increasingly named in cases that question not just his stewardship but the very ethics of his empire.

Punjab Today will continue to bring to light, in full detail, the saga of wrongdoings of the Edelweiss Group under Shah’s watch — and the uncomfortable questions it raises about accountability in India’s financial system.

For now, the fortress still stands — but its cracks are widening in full public view. ![]()

________

Also Read:

When Goliath Trips, Even Ants Take Notes

Disclaimer : PunjabTodayNews.com and other platforms of the Punjab Today group strive to include views and opinions from across the entire spectrum, but by no means do we agree with everything we publish. Our efforts and editorial choices consistently underscore our authors’ right to the freedom of speech. However, it should be clear to all readers that individual authors are responsible for the information, ideas or opinions in their articles, and very often, these do not reflect the views of PunjabTodayNews.com or other platforms of the group. Punjab Today does not assume any responsibility or liability for the views of authors whose work appears here.

Punjab Today believes in serious, engaging, narrative journalism at a time when mainstream media houses seem to have given up on long-form writing and news television has blurred or altogether erased the lines between news and slapstick entertainment. We at Punjab Today believe that readers such as yourself appreciate cerebral journalism, and would like you to hold us against the best international industry standards. Brickbats are welcome even more than bouquets, though an occasional pat on the back is always encouraging. Good journalism can be a lifeline in these uncertain times worldwide. You can support us in myriad ways. To begin with, by spreading word about us and forwarding this reportage. Stay engaged.

— Team PT