GST Reforms and Bitter Legacy: Eight Years of Crushing the Common Man

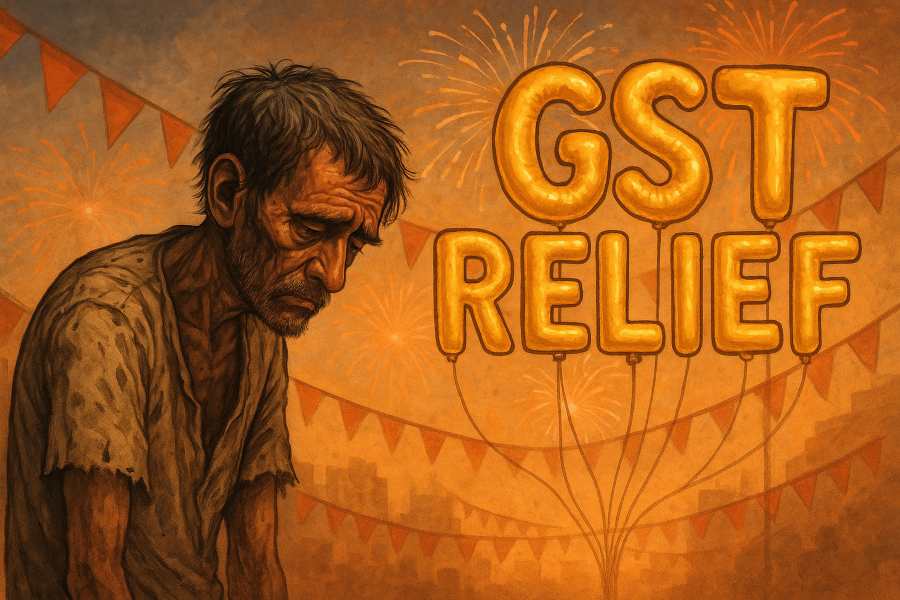

INDIA WOKE UP on September 21, 2025, to the spectacle of yet another Modi-branded festival—this time christened the “GST Bachat Utsav.” Wrapped in the language of celebration, it promised relief for households and simplicity for businesses, projecting the government as a benefactor bestowing fresh savings on the public.

But behind the fireworks and festive rhetoric lies a harsher reality: this is not a triumph to be toasted, but a long-overdue admission of failure.

For nearly eight years, the Goods and Services Tax—once hailed as the boldest reform of independent India—remained trapped in poor design, shifting goalposts, and political spin.

For nearly eight years, the Goods and Services Tax—once hailed as the boldest reform of independent India—remained trapped in poor design, shifting goalposts, and political spin.

What is now paraded as a people’s gift is, in truth, a reluctant course correction timed with electoral compulsions. To grasp the real meaning of this so-called Utsav, one must sift through the history of GST—its broken promises, hidden toll, and the lessons it holds for Indian democracy.

Broken Promises, Rising Burdens

For ninety-six harsh months, GST has broken the backbone of India’s poor and middle class, transforming what was promised as a “Good and Simple Tax” into a regressive leviathan.

Introduced in 2017 amid fanfare, it was meant to unify India’s fractured fiscal system, but instead morphed into an instrument of inequality, squeezing household budgets while corporate elites reaped windfalls.

From its inception, GST’s multi-slab structure—ranging from 5% to 28%—created a cascade of costs that hit low- and middle-income families hardest.

Unlike direct taxes, which scale with income, GST is blind to earning power: a daily-wage labourer pays the same rate on soap, grains, or medicines as a billionaire. Studies show that 64% of GST’s burden fell on the poor and middle class, while billionaires contributed barely 3%.

Inflation compounded the pain. Essentials like sanitary napkins (initially taxed at 12%), cooking oil (5–18%), and household goods saw price hikes, eroding purchasing power in a stagnant wage environment.

Inflation compounded the pain. Essentials like sanitary napkins (initially taxed at 12%), cooking oil (5–18%), and household goods saw price hikes, eroding purchasing power in a stagnant wage environment.

Small vendors, unable to claim full input credits, passed on expenses, making groceries 10–15% costlier in rural areas.

Urban families, already grappling with stagnant salaries and 5–6% inflation, faced additional hits: 18% GST on dining out, education fees, and electronics squeezed discretionary spending.

During the pandemic, when incomes collapsed, GST on health items like masks (initially 18%) felt like salt in the wound.

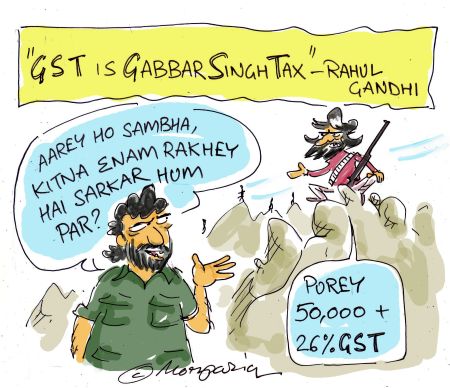

The “Gabbar Singh Tax” tagline, once satire, evolved into a symbol of resistance.

By FY 2024–25, cumulative collections had soared to ₹22.08 lakh crore, a 9.4% year-on-year growth, but this success came at the expense of consumer resilience. The informal sector, employing 80% of India’s workforce, bore the brunt of forced formalisation, widening the rich-poor divide.

Reforms in 2025: Relief or Rhetoric?

Amid mounting criticism and global headwinds, the government announced sweeping reforms in 2025. Essentials like food items, wood products, handicrafts, and footwear up to ₹2,500 moved to the 5% slab, potentially lowering household expenses by 10–15%.

Nil GST on certain grains and medicines promised relief for the poor. Middle-class families saw GST on TVs, ACs, and trucks slashed from 28% to 18%, freeing up budgets for education and healthcare.

Nil GST on certain grains and medicines promised relief for the poor. Middle-class families saw GST on TVs, ACs, and trucks slashed from 28% to 18%, freeing up budgets for education and healthcare.

Services too saw long-awaited corrections. Health and life insurance premiums, once taxed at 18%, now stand at 12%, making coverage more affordable for first-time buyers.

Education services and rail travel in lower classes were exempted or shifted to lower slabs, easing the burden on struggling households.

Small businesses—the hardest hit by GST—finally gained breathing space. MSMEs now face simplified processes and lower rates on key inputs like textiles (down from 18%/12% to 5%).

Tractor parts at 5% help farmer-entrepreneurs, while e-way bill relaxations reduce compliance hurdles. Industry leaders predict these reforms could revive the informal sector, create jobs, and boost GDP by 0.5%.

Yet the timing raises suspicion: are these reforms genuine empathy, or politically timed concessions ahead of elections?

Political and Federal Firestorms

No critique captured GST’s predatory nature better than Rahul Gandhi’s 2017 moniker: “Gabbar Singh Tax.” Evoking the iconic Bollywood villain, it symbolized how GST looted the common man.

Gandhi lambasted the BJP for turning a “Genuine Simple Tax” into a nightmare, with over 1,000 changes in just 1,826 days, fuelling evasion and complicating compliance. He highlighted how GST devastated the unorganized sector, destroying livelihoods in textiles and small trades while favouring corporates. By 2022, he was calling it “Grihasti Sarvnaash Tax” (Household Destruction Tax).

By 2025, Congress claimed credit for the reforms, arguing Gandhi’s consistent pressure forced the government’s rethink, particularly on high rates like 18% on health insurance.

By 2025, Congress claimed credit for the reforms, arguing Gandhi’s consistent pressure forced the government’s rethink, particularly on high rates like 18% on health insurance.

The “Gabbar Singh” tagline, once satire, evolved into a symbol of resistance.

At the state level, the firestorm was equally intense. The 2025–26 budget projected a 22% rise in SGST collections to ₹10.8 trillion, but actual receipts grew only 5.8%.

States accused the Centre of delaying compensation and selectively allocating funds, undermining fiscal federalism.

Opposition-ruled states called this economic coercion—a political weapon disguised as policy.

Global Shocks and the “Trump Effect”

Global politics further complicated GST’s story. With Donald Trump’s second term imposing 50% tariffs on Indian goods—citing Russian oil imports and trade imbalances—India’s exports face a ₹2–3 lakh crore annual hit. Sectors like textiles, autos, and pharma, heavily reliant on the US market, suddenly became uncompetitive.

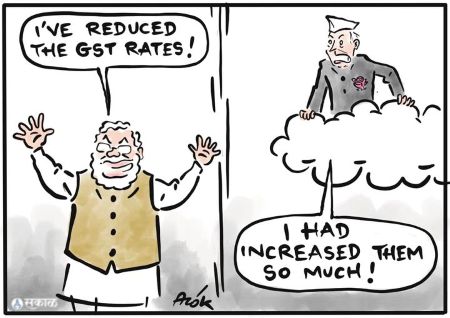

Cartoon Courtesy: South First

GST reforms, coupled with income-tax relief, aimed to stoke domestic demand and offset export losses by making goods cheaper at home.

Analysts see the rate cuts as a cushion: slashing GST on essentials to 5% or nil boosts consumption, which accounts for 60% of GDP.

Combined with fiscal measures, these steps inject ₹5.31 lakh crore into the economy, blunting tariff shocks.

But this reactive reform exposes India’s vulnerability. Without it, GDP growth could dip by 0.5–1%, showing how easily global turbulence can force domestic recalibration.

Toward a Fairer Tax

Eight years on, GST reforms mark a reluctant admission of its flaws.

Domestic outcry and global shocks forced the government to recalibrate what was once touted as a triumph.

Relief for the poor, middle class, and small businesses offers hope that GST may finally evolve into an engine of inclusive growth.

But vigilance will be key. Without fewer slabs, digital ease of compliance, and equitable sharing of revenues between Centre and states, the backbone GST broke may never fully mend.

The quill of reform is poised; let it script justice, not jargon. ![]()

________

Also Read:

EDELWEISS: SERIAL OFFENDER

Don’t Repeat Past Mistakes in Ladakh

The Indian Constitution Under Threat

Disclaimer : PunjabTodayNews.com and other platforms of the Punjab Today group strive to include views and opinions from across the entire spectrum, but by no means do we agree with everything we publish. Our efforts and editorial choices consistently underscore our authors’ right to the freedom of speech. However, it should be clear to all readers that individual authors are responsible for the information, ideas or opinions in their articles, and very often, these do not reflect the views of PunjabTodayNews.com or other platforms of the group. Punjab Today does not assume any responsibility or liability for the views of authors whose work appears here.

Punjab Today believes in serious, engaging, narrative journalism at a time when mainstream media houses seem to have given up on long-form writing and news television has blurred or altogether erased the lines between news and slapstick entertainment. We at Punjab Today believe that readers such as yourself appreciate cerebral journalism, and would like you to hold us against the best international industry standards. Brickbats are welcome even more than bouquets, though an occasional pat on the back is always encouraging. Good journalism can be a lifeline in these uncertain times worldwide. You can support us in myriad ways. To begin with, by spreading word about us and forwarding this reportage. Stay engaged.

— Team PT