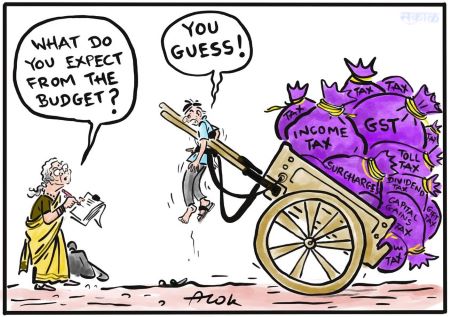

As the Budget is set to be presented on 1 February, growth optimism confronts inflation, fiscal constraints and global trade risks

WHEN FINANCE MINISTER Nirmala Sitharaman presents the Union Budget for 2026–27, she does so against a backdrop of headline confidence and lived economic strain.

India remains among the world’s fastest-growing large economies, with official projections for FY27 placing real GDP growth between 6.8 and 7.2 per cent after a strong performance in the current year. Public capital expenditure, resilient services exports and stable macro fundamentals continue to anchor optimism.

Nirmala Sitharaman

Yet the underlying economic mood is more cautious. Demand recovery is uneven, global trade conditions are turning adverse, and cost pressures persist at the household level.

This makes Budget 2026–27 less about headline ambition and more about fiscal calibration—how to sustain momentum without overstretching public finances or weakening household confidence.

Inflation, Welfare and the Household Squeeze

Official inflation numbers point to comfort, with CPI easing sharply during most of 2025 and core inflation remaining benign. But inflation is not experienced in averages.

Food prices—especially pulses, vegetables and perishables—remain volatile, disproportionately affecting lower-income households. At the same time, education, healthcare and transport costs continue to rise, quietly eroding disposable incomes across urban and semi-urban India.

In this context, welfare spending has evolved into a critical economic stabiliser. Rural employment programmes, food and fertiliser subsidies, affordable housing schemes and targeted transfers underpin consumption in vast sections of the economy. Any abrupt fiscal tightening in these areas risks weakening demand just as private consumption shows early signs of recovery.

In this context, welfare spending has evolved into a critical economic stabiliser. Rural employment programmes, food and fertiliser subsidies, affordable housing schemes and targeted transfers underpin consumption in vast sections of the economy. Any abrupt fiscal tightening in these areas risks weakening demand just as private consumption shows early signs of recovery.

The Budget’s challenge lies in rationalising expenditure without dismantling its shock-absorbing role, particularly amid climate volatility and rural income uncertainty.

Middle-Class Taxes and Consumption Signals

For the salaried middle class, expectations from this Budget are restrained but clear. While GST stability and controlled inflation have supported selective consumption—reflected in strong earnings of companies such as Nestlé India—real disposable incomes remain under pressure.

Wage growth has not kept pace with living costs, and the simplified personal tax regime offers limited relief through deductions. Private Final Consumption Expenditure accounts for over 60 per cent of India’s GDP, making household sentiment central to growth sustainability.

Premium consumption has held up, but mass and mid-segment demand—entry-level housing, small automobiles and discretionary goods—remains cautious.

A Budget overly skewed towards capital expenditure without reinforcing consumption risks entrenching a two-speed economy: strong macro numbers alongside fragile household confidence.

Fiscal Discipline, Investment and Global Headwinds

From the perspective of investors, Budget 2026–27 will be judged by its commitment to fiscal credibility. With over half of the annual fiscal deficit already accounted for by December, markets will focus less on headline numbers and more on the quality of consolidation—realistic disinvestment targets, transparent asset monetisation and restraint in off-budget borrowing.

Inflation management, anchored by the credibility of the Reserve Bank of India, remains the Budget’s silent constraint. Excessive stimulus risks reigniting price pressures, while excessive restraint could stall demand. Capital expenditure in infrastructure, urban transport and energy continues to be the safest fiscal lever, supporting medium-term growth without overheating the economy.

Inflation management, anchored by the credibility of the Reserve Bank of India, remains the Budget’s silent constraint. Excessive stimulus risks reigniting price pressures, while excessive restraint could stall demand. Capital expenditure in infrastructure, urban transport and energy continues to be the safest fiscal lever, supporting medium-term growth without overheating the economy.

Externally, renewed tariff-centric trade policies in the United States under Donald Trump pose risks for export-oriented sectors such as steel, automobiles and pharmaceuticals. Rather than reactive protectionism, the Budget must focus on competitiveness—lower logistics costs, faster GST refunds, stronger export credit and regulatory predictability.

A Budget That Must Hold Together

Ultimately, Union Budget 2026–27 will be judged not by headline announcements but by coherence. It must balance welfare with discipline, consumption with investment, and domestic priorities with global realities.

Protecting the vulnerable, acknowledging middle-class fatigue, enabling industry and reassuring investors—while preserving fiscal credibility—will define success.

Protecting the vulnerable, acknowledging middle-class fatigue, enabling industry and reassuring investors—while preserving fiscal credibility—will define success.

If the Budget achieves this balance, it may not generate instant applause, but it will reinforce confidence at a moment when economic resolve matters far more than rhetoric. ![]()

__________

Also Read:

Davos Diversion: How Public Money Is Burnt for Promises That Never Deliver

Disclaimer : PunjabTodayNews.com and other platforms of the Punjab Today group strive to include views and opinions from across the entire spectrum, but by no means do we agree with everything we publish. Our efforts and editorial choices consistently underscore our authors’ right to the freedom of speech. However, it should be clear to all readers that individual authors are responsible for the information, ideas or opinions in their articles, and very often, these do not reflect the views of PunjabTodayNews.com or other platforms of the group. Punjab Today does not assume any responsibility or liability for the views of authors whose work appears here.

Punjab Today believes in serious, engaging, narrative journalism at a time when mainstream media houses seem to have given up on long-form writing and news television has blurred or altogether erased the lines between news and slapstick entertainment. We at Punjab Today believe that readers such as yourself appreciate cerebral journalism, and would like you to hold us against the best international industry standards. Brickbats are welcome even more than bouquets, though an occasional pat on the back is always encouraging. Good journalism can be a lifeline in these uncertain times worldwide. You can support us in myriad ways. To begin with, by spreading word about us and forwarding this reportage. Stay engaged.

— Team PT